|

20A032 Bonds by Jim Davies, 8/11/2020

They differ from stocks. If you buy a share in the stock of a company you may gain well from both dividends and rises in its price, but you are promised nothing else; high risk, potential of high gain. With bonds, you are. Your only risk lies in the reliability of the promise. The bond seller promises to return your money at a certain date, plus interest at a certain rate. If you wish, you can sell the bought bond prior to that date, for whatever it will fetch in the market. Bonds are sold both by companies, and by governments at all levels. Company bonds are honest; the others are not; because their promise is contingent on their de-facto power to steal all the money needcd to pay both interest and returned principal. When selling (issuing) a bond, a company is promising to honor its terms or go out of business; it is placing the buyer alongside the firm's owners. Provided only that it can remain solvent, the bond buyer will be paid. The risk is not zero, but it's as small as can be. Bearer bonds were a useful way to store money while earning interest on it, and doing so without the benefit of government oversight; they were issued without registration of the owner so they were anonymous, rather like a $100 bill except that any value could be named. A single document is so much easier to carry around than a suitcase full of Benjamins. There was no recourse if stolen or counterfeited (again, like Federal Reserve Notes) but they nicely enabled tax-free trading. The Feds hated that and in 1982 made them unobtainable. Come the zero government society, they may well re-appear; but since there will be neither tax nor snoops, it's not clear that they will offer much advantage over registered, more secure kinds of bond. Town, State or Federal government bonds also come with a guarantee, and can reasonably claim that since governments go broke less often than firms, the risk is smaller yet. And in addition, the interest paid is not taxable! That can be a very attractive selling point, especially for a high-income investor who is being taxed at the maximum rate on the "progressive" scale. Still, it's dishonest. If I were to sell you a bond for $95 with a promise to buy it back a year hence for $100 and steal the money to do so, I'd be arrested for theft. It would be a fraudulent, void contract. But that law doesn't apply to governments. They give themselves a break; "no man is above the law" is just not true and never was. It's curious, and sad, that financial advisors never seem to point out this very obvious fact. Municipal bonds are for example often recommended as a valuable part of any portfolio, on account of their high security and tax-free status. Such advisors would not propose buying a bond issued by a Mafia family, even if it offered an even higher rate of return and even though that family had a rich collection of judges in its pocket and was therefore very secure; for the advisor would know (and say) that it was a criminal enterprise. Why the double standard? The two cases are identical; why is one wrong and the other, right? The only answer: government writes the laws and Cosa Nostra doesn't. During the final months of the Government Era, as I predict in Transition to Liberty, taxes will become uncollectible - for payers will realize that clerks who handle their receipt and administration are quitting their jobs, as are the clerks who enable the courts (which might otherwise penalize the tax refusenik) to function. Therefore, the value of government bonds will plunge; there will be no money to redeem them, when their due-date arrives. No "money", that is, to reflect their presumed value; government may very well print the stuff and redeem them for their nominal value, but the purchasing power of the stuff used to do so will eventually buy a cup of coffee, provided a silver dime is added. Those are two good reasons, then, never to invest in a government bond. First, it's fundamentally dishonest because the buyer knows full well that the vendor is engaging in fraud; and second, when the vendor begins his final collapse the bond will lose all its value.

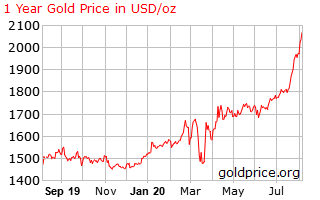

That may happen sooner rather than later. This year the dollar price of gold has increased 36% from its multi-year level around $1,500/oz, meaning that the US dollar has lost 26% of its real value in 7 months. The bogus plague may be the primary cause, but government is using that to destroy stability and confidence all round, and that can only increase interest in genuine money. |

|

||||||||||||||||||||||||||||||||||||||||||

The second of those problems will also unfortunately apply to honest bonds issued by companies; they sell it today for $95 and buy it back a year hence for $100 as contracted, but meanwhile the nominal $100 has shrunk in real value to $10 or $1 or maybe 10 cents, due to government's last desperate attempt to keep its currency afloat. Remedy? - shop around for a company bond denominated in gold. Can't say I've noticed any, yet; but demand will trigger supply.

The second of those problems will also unfortunately apply to honest bonds issued by companies; they sell it today for $95 and buy it back a year hence for $100 as contracted, but meanwhile the nominal $100 has shrunk in real value to $10 or $1 or maybe 10 cents, due to government's last desperate attempt to keep its currency afloat. Remedy? - shop around for a company bond denominated in gold. Can't say I've noticed any, yet; but demand will trigger supply.