|

21A026 Genuine Glitter by Jim Davies, 7/13/2021

On a certain social medium recently a contributor wrote that the "USA should have stayed on the gold standard." Someone else responded sarcastically:

So I wrote to ask what it is about paper, fiat money that he sees as superior to gold, but (funny thing) he didn't reply. Typical "liberal"; they are generous with scorn but very shy about engaging in reasoned discussion. During the 1800s, prices fell a little almost every year (imagine that!) Items that cost $1.00 in 1800 cost only 60 cents in 1900. The reason was that money consisted of gold and silver, whose supply cannot be increased quickly; and in that Century production increased faster. So more goods were traded for the same amount of money; ie, prices dropped. That encouraged savings, ie investment. No wonder growth was so healthy. Gold is rare and hard to counterfeit, so is very well suited to serve as a medium of exchange; but its greatest virtue is that government cannot control it. The amount in circulation is fixed by the market, not by the Treasury. Not that the Treasury doesn't try; prior to 1913 the US was on a gold "standard", meaning that government could and did manipulate it somewhat. It decreed that two metals, not one, would constitute US currency; gold and, for smaller amounts, silver. So far so good, but incredibly, it arrogantly set their relative values in the ratio of 16:1, as if demand and supply would never change it! But they did; today it's 68:1. For government, fiat "money" brings the huge advantage that it can purchase votes with no need visibly to raise taxes - just by creating more of it than true production increases. It has done so ever since 1913, at an average rate of just under 4% per year, which causes prices to double every 18 years. So since Congress created the FedRes in 1913, the "dollar" has lost 99% of its value. How much more it will lose if Biden really spends six trillion dollars he doesn't have, on much-needed infrastructure repair, we shall eventually find out. So much for the alleged superiority of fiat money over gold. In the coming zero government society nobody will dictate what the market shall choose to use for money; probably both gold and silver will be in use, and others too. Bitcoin may well play a part; its popularity is reflected in a tenfold rise in its dollar exchange rate since the Bogus Plague began, from $5,000 to over $50,000. As well as a medium of exchange money needs to serve as a store of value, and for that purpose a key merit is that its supply is fixed, or nearly so. For that purpose, Bitcoin has a slight advantage over gold because once its limit of 21 million coins has been reached (it's now at 18.5 million) that property will be achieved. In contrast more gold can always be mined, so a very small annual increase in its supply is feasible; but the transfer of a gold coin in voluntary exchange is simpler to understand than blockchain technology and even more private. What fun it will be, to discover which form of money is preferred in the coming zero government society. |

|

|||||||||||||||||||||||||||||||||||||||||||

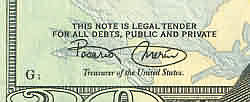

While there's no promise on these "dollar bills" (their actual name is "Federal Reserve Notes") there is the sinister phrase stating that each is "legal tender"; that refers to a law that forces every creditor to accept it in payment of a debt. So even on its face, today's "paper money" bears no relationship to the real thing; it's just fiat money quite like the tokens in the game of Monopoly - except that there really is a monopoly and it's not a game.

While there's no promise on these "dollar bills" (their actual name is "Federal Reserve Notes") there is the sinister phrase stating that each is "legal tender"; that refers to a law that forces every creditor to accept it in payment of a debt. So even on its face, today's "paper money" bears no relationship to the real thing; it's just fiat money quite like the tokens in the game of Monopoly - except that there really is a monopoly and it's not a game.