|

22A020 A Golden Future by Jim Davies, 5/17/2022

That future is being delayed by the stupid and horribly dangerous games governments are playing East of Hungary, but one of the few useful signals to emerge from that war is the central importance of money among nations. So as to pour gasoline on the fire which they provoked, countries in NATO closed down as much trade as they could with Russia, not only declining to buy much-needed gas and oil for shivering Europeans, but cutting the SWIFT system by which banks can efficiently transfer money across borders and change it from one currency to another. Obedient commercial puppets of the Biden Gang closed their Russian branches - except for Burger King, which is 85% owned by a Russian. In retaliation the RusGov added to the closures and announced that oil was still for sale, but only in exchange for rubles. If you have no rubles, you'll need to buy some - with gold perhaps, but also with $s or €s (so why bother? - beats me!) When these heavily-armed playroom thugs have evaporated for want of employees, the resulting world market will choose what to use for money, and it won't be any form of paper, or currency created at the touch of a computer key. Participants will require a medium of exchange that is durable, not just physically but in terms of stable value. Crypto will be a strong contender, because Bitcoin (for example) promises to be mathematically impossible to inflate, after 21 million units are in circulation. If it financed all buying and selling, rising production efficiencies would result in usefully falling prices, a.k.a. deflation, which has not been seen since 1913 but which did feature in the wealth explosion of the 19th Century.

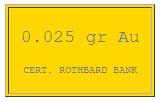

Gold and silver, though, will also be popular for trading, in coin form; because they too can not be falsified or rapidly mined. The above-ground world supply of gold is about 200,000 tonnes, of which nearly half is in jewelry; if most of that stays where it is there may be a little over 100,000 tonnes available for minting. A further 50,000 tonnes has been identified ready to be mined, but mining is a slow process, so inflation would be possible but very slow. Suppose then that 100,000 tonnes (100 million kilograms) were made into coins and bars and for illustration also that it replaces half the world's currencies (crypto taking over the balance.) Today's world money supply is about $100 trillion,* of which half is $50 trillion, so the exchange rate would be (50T/100M =) $500,000 per kg, or $500 per gram. Today's price is $60 a gram, which is why gold is such a good investment. Put another way, when governments fold, all fiat currencies will expire worthless; to which 2 milligrams of gold per dollar is close. It's comparable to those gold leaves that float in a bottle of Goldschläger. Hey, a $1 bill will have some use - as wallpaper. Gold is heavy stuff (over 9 times the density of water) and a 30-gram coin (one ounce is about 31 grams) or two would be weighty in pocket or purse; however a couple would purchase goods that sell today for nearly $4,000. So there will be a need, obviously, for smaller coins. A 5-gram coin would be feasible, and would buy what $333 does today, but smaller coins might be too easy to lose - though the RusGov has minted a 1-gram gold coin stamped as 5,000 rubles. The market will invent ways to overcome that inconvenience; one I visualize would be a plastic card with a read/write mag strip, and widespread availability of reverse ATMs: machines that accept gold coins and "write" their value on the card, which would then be used in retail purchases like a debit card today, and each transaction writes the depleted balance on the mag strip. The retailer accepting payment will recover gold from the firm operating the reverse ATM. Naturally, a small fee will be charged for each transaction. That method wouldn't preclude storing gold coin in a bank and drawing on it with a debit card, but that does introduce a third party and the need to trust him.

Another idea for making gold convenient for small purchases is to produce sheets of it, with about the thickness of plain paper, perforate them and affix the result (each about the size of a postage stamp) to a waxy backing. These would be conveniently held in wallet or purse and the requisite payment made by peeling or tearing off one or more. I calculate that each stamp-size leaf would have a buying power equivalent to that of $1.50 today. Any gold-beaters or -rollers out there, please contact me via the "About" page. So a range of alternative payment methods will be devised by the market, with trustworthy third parties helping as above for example, but always the agreed price will be a certain weight of gold, regardless of their national origin and the way the bars are decorated. The unit of "currency" will be the gram, or kilogram etc. The need for "exchange rates" will not arise.

* My estimate: "M-3" in the US is $25 trillion, and the US produces about ¼ of all the world's goods and services. |

|

||||||||||||||||||||||||||||||||||||||||||||||