|

24A040 The Government Debt Vortex by Jim Davies, 10/15/2024

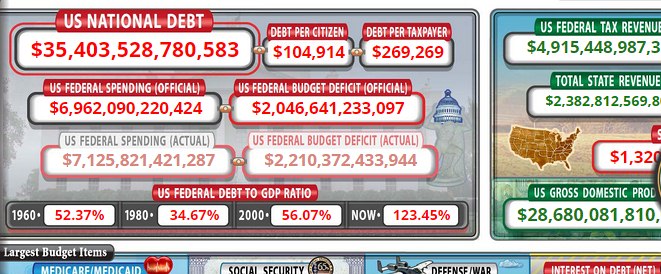

According to that very informative source, usdebtclock.org , the FedGov owes a total of $35 trillion and counting. That's the accumulated total of its overspending during the last 3 or 4 decades. One trillion is a million million, or ten to the 12th power; 1012.

Divide all that by a hundred million so as to make it easier to visualize, and we have a home mortgage of $350,000. It may be feasible to get a 20-year loan at 6% on that, if you earn $100K. It would cost about $30K a year - within the usual rule of thumb that says you can afford a house priced up to three times your salary. That's because the banker knows you need also to buy a car, food, drink etc. So does the FedGov. To compare to that home owner's case, it would need close to $10 trillion in revenues, with plenty of room left after other spending. But it doesn't; revenues are only $4.9T. And every cent of that is already spoken for, as is the shortfall of $2.2T. So, the FedGov would certainly not get a mortage loan approved. But it took one anyway. To manage the trick, it artificially lowered the interest rate (closer to 3% than 6) and when it still falls short it prints more money - by a complicated arrangement with its quasi-central bank, the Federal Reserve, and its member banks. That extra loot is also a form of tax, but levied without the nuisance of having to pass a law to impose it. It causes inflation, which we pay about a year later. In that way, it kicks the can down the road, or keeps playing musical chairs. Each elected round of government hopes the music will not stop during its term in office. How long can that go on? One obvious way in which the music would stop is that lenders decline to lend. Here's an explanation of who are the lenders. Notice that two thirds of the debt is owned domestically, and that a third of that is held by the Federal Reserve, which makes the purchases that create new "money." Another third of it is labeled "other domestic", which doesn't tell us much. State and local governments hold some, but a whole heap of it is owned by mutual funds and pension operators. Then a third of the total is purchased by foreign governments, of whom Japan is the largest and China, second. All of them buy Treasuries as a "safe" way to park money they don't expect to need for a few years, and none of them except the FedRes is obliged to keep it there permanently. If this is a "safe" place, it tells us much about how unsafe must be every other government security in the world. It tells us also something about the safety of pension and mutual funds. One option (for the FedGov) is to forget about repayment (the mortage example above) and just pay the interest, currently $0.95T a year, and hope the music keeps on playing. That's what they've been doing. But they don't have total control over the interest rate, and if others seeking capital offer more than the artificially low 3%, that interest payment will have to rise. At a more realistic 6% it would be $2T a year, and so on; and since revenues will stay around $5T that means the FedRes will have to create more "money" and hence more inflation. As inflation rises, investors will note that the true return they are getting is being diluted because each dollar buys less, so they will demand still higher nominal rates; and so the vortex will spin faster and deepen. See the problem? It's not sustainable. When exactly it will collapse I cannot predict; but collapse it will. With it will go the value of mutual funds and pensions and all. Hyperinflation will happen. The best shelters will be gold and silver coin, real estate, and probably crypto. Dollars will be useful only as wallpaper and to pay off loans by your bank, and be sure to keep handy a wheelbarrow to get them there. "Fiat" money - that can be created on government command - won't exist in the coming zero government society, because there won't be a government to command it. Instead the market will choose a stable medium of exchange, and five thousand years of experience suggest that it will be gold. The sooner, the better. |

|

||||||||||||||||||||||||||||||||||||||||||