|

25A006 Changing an I to an E? by Jim Davies, 2/11/2025

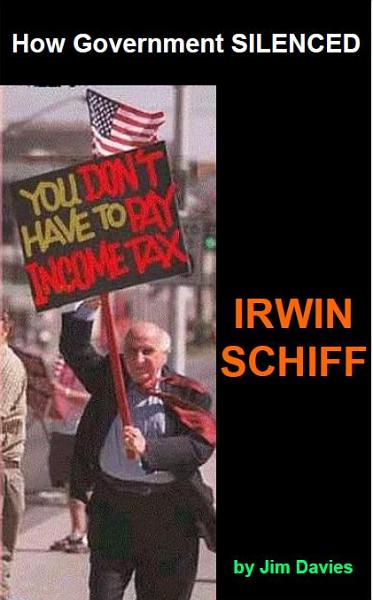

No part of the FedGov is more intensely loathed in America than the IRS, the Internal Revenue Service. That part of the US Treasury confiscated $2.15 trillion in 2024 as personal income tax (see here at page 108) even though there is no law entitling it to do so. To complain or to deal with its agents is to punch jelly, without the possibility of a tasty treat when exhausted. Every Libertarian candidate for President has promised to "abolish the IRS and replace it with nothing" but none of them have been elected. In 2016 Donald Trump expressed frustration about the IRS but in four years failed to end its miserable existence. Now, he just may be reconsidering. It's not just that the IRS rips off an average of 20% of everything we earn, in effect making us work for the FedGov every Monday. It's the arrogant way their system peers into every part of our financial life. It holds detailed data on 130 million of us, all of which is, properly, completely private.

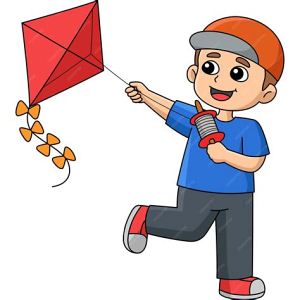

So DJT has flown a kite: he suggests the Income Tax might be replaced by a system of tariffs. That was actually the source of revenue tapped by the founders; the very first Act the Congress passed was to lay a tax on certain imports. Trump's idea is that by slapping a big tax on goods from overseas, they would be more expensive, so FedGov could protect or revitalize domestic industry while collecting revenue for itself. He's called it an External Revenue Service, or ERS. The first huge danger is that he'll end up with both; that the i-tax may be cut a bit but not abolished altogether, while the e-taxes would increase what the government rips out of the economy. Instead of replacing the I with an E, we'd end up with both. And guess what: (I2 + E) > I1. But suppose, against the odds, he and his party in Congress do actually pull off this idea and achieve a complete replacement; an E for an I. It's possible. Assuming the total ripped off is the same as the loot presently stolen, it would bring gains and losses, depending on the viewpoint. Gains (to someone):

Losses:

All of this fine calculation, however, is trivial compared to the vast net gains waiting to be enjoyed by zeroizing all forms of tax, and the government they feed. The utter waste of that layer of parasites is gigantic, and this commentary on the relative merits of Tax A versus Tax B is like choosing between getting shot or getting drowned. Away with the lot of it!

|

|

||||||||||||||||||||||||||||||||||||||||||